BNPL Battle: Klarna vs Afterpay Showdown!

By Sonika Kamble on 1/25/2024 · 26 minute read

In recent times, the allure of Buy Now, Pay Later (BNPL) services has seen a significant uptick, providing shoppers an accessible avenue to stagger payments for their purchases. Among the frontrunners in this space, Klarna and Afterpay stand out, capturing the interest and trust of consumers widely.

Deciding between Klarna and Afterpay? It’s a common conundrum! Both Klarna and Afterpay are titans in the Buy Now, Pay Later (BNPL) arena, providing the convenience of splitting your payment into easier, digestible installments over time. Yet, when you peel back the layers, you’ll find that each has its unique highlights that could sway your decision one way or another.

In this article, we’re going to dive deep into the specifics of Klarna versus Afterpay, guiding you towards making the best decision for your needs.

What is Klarna?

Klarna hails from the innovative landscape of Sweden as a financial technology entity, enriching the e-commerce realm with its versatile payment offerings. The roots of this pioneering company stretch back to 2005, an endeavor brought to life by three visionaries: Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson. With its main hub stationed in the vibrant city of Stockholm, Sweden, Klarna’s influence and operations extend globally, with a presence in 20 countries, showcasing its international flair and commitment to simplifying e-commerce transactions.

What is Afterpay

Launched Down Under in 2014 by founders Nick Molnar and Anthony Eisen, Afterpay brings the charm of the buy-now-pay-later (BNPL) model to eager shoppers. This Australian gem lets you snag your goodies immediately while spacing the payment out into four manageable slices over a period of six weeks. With its roots firmly planted in Sydney, Afterpay has spread its wings far and wide, making its mark in lands including Australia, New Zealand, the United States, the United Kingdom, Canada, and France.

Klarna vs Afterpay: Features

Klarna and Afterpay stand out as leading choices in the “buy now, pay later” (BNPL) market, offering a seamless way for shoppers to spread out their payments for online purchases. Let’s dive into how they stack up against each other:

In a world where the convenience of online shopping reigns supreme, Klarna emerges as the promising solution that transforms every purchase into a breeze. This innovative platform is not just another payment option; it’s a gateway that opens up an array of benefits for shopaholics and savvy spenders alike. As you embark on your next digital shopping spree, Klarna stands by, ready to make your experience as smooth as silk.

-

Shopping Journey: Klarna transforms the online purchasing journey into an effortless adventure, by introducing a “Pay Later” feature during checkout. This option neatly divides the total payment into four manageable installments, ensuring a smooth and hassle-free shopping experience.

-

Worldwide Accessibility: Klarna’s presence spans across various countries, offering its services in collaboration with an extensive network of online retailers. This wide accessibility ensures that Klarna caters to a global clientele, opening doors to shoppers around the world.

-

Klarna Application: With Klarna’s specialized application at your fingertips, managing your shopping spree becomes a breeze. It’s your go-to hub for overseeing purchases, keeping tabs on when your goodies will arrive, and handling payments with ease.

-

Deferred Payment and Flexible Financing: Beyond its “Pay Later” service, Klarna also provides an assortment of financing solutions, encompassing options for extended terms. These include periods with no interest and fixed-duration financing plans.

-

Loyalty Perks: Dive into Klarna’s exclusive “Vibe” rewards program, where users are treated to a treasure trove of rewards, special deals, and discounts from a host of partner brands.

-

Refund Assurance: Klarna’s innovative “Pay Later” option makes returning items a breeze for customers by ensuring they get their money back seamlessly, streamlining the entire returns procedure.

Afterpay has rapidly emerged as a prime player in the buy now, pay later arena, offering a seamless shopping experience that marries convenience with flexibility. This innovative payment solution allows shoppers to spread the cost of their purchases over four equal payments, with no interest charged, making big buys feel a little easier on the wallet. It’s a modern twist on traditional layaway plans, but with the instant gratification of taking your items home right away. Whether you’re eyeing the latest gadget or splurging on fashion, Afterpay makes it more manageable to indulge responsibly.

-

Payment Plans: With Afterpay, shoppers have the convenience of dividing their total purchase amount into four manageable installments. These payments are scheduled every two weeks and can be easily made at the time of checkout with numerous online merchants.

-

Late Fees: Afterpay implements late fees for payments that aren’t made on time. These fees can fluctuate based on the overall purchase value and the specific regulations of the country.

-

Digital Bazaar: Immerse yourself in Afterpay’s “Shop Directory,” a vibrant marketplace brimming with participating e-retailers ready to enhance your shopping journey.

-

Mobile Connectivity: The Afterpay mobile app offers users the convenience of tracking their payment plans, viewing upcoming installments, and unlocking special deals from affiliated retailers, all at their fingertips.

-

Credit Inquiries: During the signup process, Afterpay usually conducts a soft inquiry into your credit history. This gentle scan is designed not to affect your credit rating in any way.

-

Zero Interest Wonder: With Afterpay, you can enjoy the luxury of interest-free installment payments. But remember, while interest doesn’t make an appearance, late fees will pop up if a payment misses its deadline.

Afterpay vs Klarna: Pricing & Plans

Klarna and Afterpay stand out as the leading choices in the burgeoning buy now, pay later (BNPL) market. Each platform tempts shoppers with the enticing option to snag their must-haves immediately and spread the cost over several payments. Despite their closely matched offerings, a closer inspection reveals distinct variations in their pricing structures and payment schemes.

Klarna pricing

- Split It Up: With this choice, shoppers can snag their must-haves right away and split the payment into four manageable chunks over a six-week span. Best of all, as long as payments are made punctually, buyers are treated to this convenience without any added interest or fees.

- Slice it up: With this choice, you can acquire your desired item straight away and spread the cost over an extended period, up to 36 months. The interest rates will adjust based on how much you spend and the repayment timeframe you select.

- Buy Now, Pay Later: Ever wanted to snag your favorite items without paying upfront? Their “Buy Now, Pay Later” scheme gives you the luxury to shop now and make the payment within 30 days. Keep in mind, though, a tiny hiccup in remembering to pay on time will attract a late fee of $7. So, mark your calendars!

Afterpay pricing

-

Paying in four chunks: This nifty feature lets buyers snag what they want immediately but spread the cost across four payments over six weeks. The best part? It’s absolutely interest-free and fee-free, as long as payments are made punctually.

-

Spread the Cost: Dive into your shopping spree without draining your wallet at once! Opt for our monthly installment plan and enjoy the luxury of spreading your payment across up to 12 delightful months. Just a little heads-up, though - keep an eye on the calendar, as there’s a modest $10 late fee for any payments that slip past their due date.

Klarna Vs. Afterpay Pros & Cons

Klarna and Afterpay stand out as leading lights in the Buy Now, Pay Later (BNPL) arena, each offering a unique set of advantages and drawbacks. Let’s dive into a side-by-side comparison of these two financial juggernauts:

Klarna Pros:

- Enjoy the pleasure of no additional costs or fees when installments are settled promptly.

- Accessible at more than a quarter of a million retailers, this feature presents an impressive range of opportunities for users. With options sprawling across diverse marketplaces, you’re guaranteed a seamless, hassle-free shopping experience at an expansive list of establishments. Whether you’re hunting for niche items or everyday essentials, this extensive network ensures your needs are covered, no matter where you are.

- Provides a range of payment options, such as Pay in 4, Slice it, and Pay in 30 days, catering to different financial needs and preferences.

- Provides a digital card that seamlessly works for both online shopping and physical store purchases.

- Provides a handy mobile application designed to streamline the process of monitoring payments and overseeing your account.

Klarna Cons:

-

If wielded without a thoughtful approach, it can easily usher one into the realm of excessive spending.

-

Might not be accessible to all readers

-

Missing a payment can have an impact on your credit score.

In the realm of modern finance solutions, Afterpay stands out as a gleaming example of consumer convenience and innovation. This pioneering service has effectively turned the traditional shopping experience on its head by enabling shoppers to purchase their desired items instantly, while allowing them to pay for them later in manageable installments. This financial model not only offers a breath of fresh air in how we approach buying goods, but it also injects a new level of trust and freedom into the consumer-market relationship. Afterpay has, without a doubt, redefined the boundaries of retail, making it a beloved feature among a wide range of shoppers seeking flexibility without compromising on their purchasing power.

Afterpay Pros

- Enjoy the freedom of zero interest and fee-free payments, provided your installments are settled promptly.

- Accessible through a vast network of more than 100,000 vendors

- Presents an easy and uncomplicated payment scheme.

- Resets your credit worries at the door; we don’t greet you with a harsh credit inquiry when you join us.

- Provides a user-friendly mobile application designed to simplify the process of monitoring payments and overseeing your account.

Afterpay Cons

- May result in excessive spending if wielded without caution

- Might not be accessible to all individuals

- If you falter on a payment, it could dent your credit score. Whether it’s a slip-up or oversight, missing a due date isn’t just about a late fee—it could leave a mark on your credit history. This tiny misstep has the potential to reverberate through your financial standing, subtly altering how lenders view your creditworthiness. So, it’s wise to keep those payments punctual to ensure your credit score remains as polished as possible.

In essence, both Klarna and Afterpay stand out as commendable BNPL services, each bringing its unique advantages and disadvantages to the table. Determining the optimal service boils down to your specific requirements and tastes.

Klarna reviews

Klarna shines brightly with a splendid 4.2-star score on Trustpilot, a glowing testament from over 1 million critiques. Here’s a peek at what users are raving about when it comes to Klarna:

"The magic of spreading the cost over time without the burden of interest or extra charges."

"Embracing the simplicity and ease of leveraging Klarna both online and within brick-and-mortar shops."

"The user-friendly mobile application."

"The hallmark of any thriving business is its customer service. It’s the warm, friendly smile that greets you at the door, the prompt and attentive care that follows, and the sincere follow-up that leaves you feeling valued and heard. Excellent customer service isn’t just about solving problems; it’s about creating a relationship, a connection that transcends the mere transactional. It’s the magic ingredient that transforms a one-time visitor into a lifelong loyal customer. Whether it’s a small gesture of kindness or going the extra mile to ensure satisfaction, it’s these moments that etch a brand into our hearts and minds."

Here’s a rundown of some aspects that customers find less appealing about Klarna:

"Watch out, those tardy charges might pack a punch on your wallet."

"Running a credit check has the potential to impact your credit score."

"Not every brand is on board with Klarna."

"At times, the app might experience a few hiccups."

Afterpay reviews

"I love Afterpay! It's so convenient to be able to buy something now and pay for it later. I've never had any problems with the service and I always get my payments on time."

"Afterpay is a lifesaver! I'm a student and I don't always have the money to buy things outright. With Afterpay, I can spread out the payments and make it more affordable."

"I've been using Afterpay for a few months now and I've been really happy with it. The app is easy to use and the payments are always on time. I would definitely recommend it to anyone looking for a BNPL service."

Klarna Vs Afterpay: Which is best for an e-commerce business?

Explore the key aspects to determine the top choice for an e-commerce store:

Payment Options

Klarna and Afterpay make shopping more budget-friendly by allowing shoppers to divide their payments into easy-to-manage chunks. Klarna’s “Pay Later” feature lets you spread the cost over four equal installments, and Afterpay presents a matching four-payment scheme. Best of all, both services usually come without the burden of interest on these payments.

Late Fees

Both platforms can charge extra for delayed payments, making it imperative to know their respective fee policies and conditions linked to overdue payments. It’s important to keep your customers in the loop about these possible additional costs.

Geographic Availability

Think about the global reach of each platform. Klarna boasts accessibility across various countries, making it an excellent choice for businesses looking to cater to an international clientele. On the other hand, Afterpay might have certain geographical restrictions, limiting its utility for wider reach.

Integration

Consider the integration smoothness of each service with your e-commerce setup. The simplicity of getting things up and running, along with the overall user journey, can differ between Klarna and Afterpay. Opt for the service that meshes well with your current systems and operational flows.

Customer Experience

Considering the tastes and inclinations of your customers is key. A portion of your shoppers might be drawn to the user-friendly design and functionalities offered by Klarna, whereas others could be more enchanted by the allure of Afterpay. Getting to know the preferences of your target demographic will guide you in selecting the most suitable option.

Marketing Support

Delve into the myriad of marketing boosts and promotional perks that Klarna or Afterpay might extend to online retailers. This could encompass everything from joint branding efforts and campaigns to exclusive discounts or unique promotional offers aimed at driving sales.

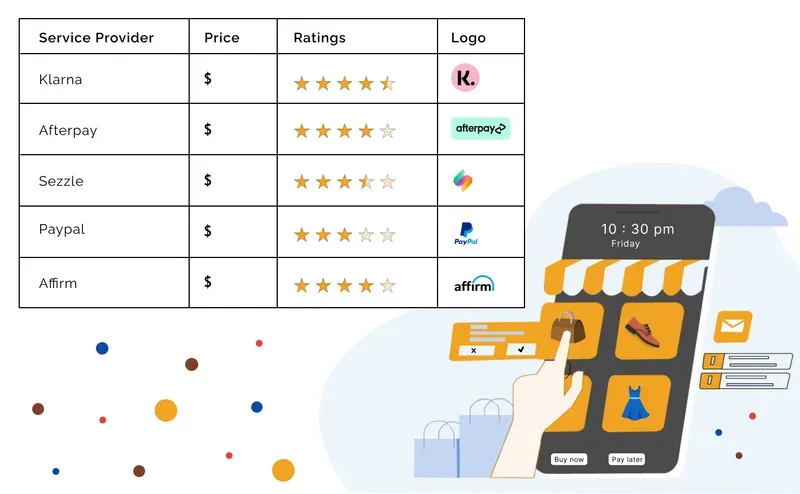

Klarna vs Afterpay: Alternatives

In the realm of “buy now, pay later” services, a multitude of options stand alongside Klarna and Afterpay, offering flexibility and convenience to shoppers eager for alternative payment methods.

-

Sezzle: Empowers shoppers by breaking down payments into four manageable, interest-free chunks, ensuring purchases are as affordable as they are enjoyable.

-

[Affirm](https://instasell.io/blog/affirm-vs-afterpay): Offers a range of point-of-sale financing options, featuring different term lengths and interest rates, ensuring customers enjoy flexibility in their choices.

-

PayPal Pay in 4: Dive into a smooth checkout journey with PayPal’s installment option, spreading your purchase cost over four equal payments.

-

QuadPay offers a convenient solution for shoppers looking to stretch their dollar further. By dividing your purchase into four equal payments without any interest fees, it makes indulging in your desired online treasures a breeze.

-

Splitit delivers a seamless installment payment solution that enriches the shopping journey, doing away with the fuss of credit checks or tedious applications. This innovative approach allows customers to enjoy their purchases without the usual financial hoops, offering a smoother, more enjoyable buying experience.

-

Zip Pay offers convenient payment solutions without the burden of interest, presenting a compelling option for consumers seeking financial flexibility

-

Shop Pay Installments: Seamlessly integrated with e-commerce platforms, this service provided by Shopify allows for convenient installment payment plans, making it an excellent choice for both shop owners and online shoppers.

How Are Klarna and Afterpay Similar?

Klarna and Afterpay serve up the increasingly popular buy now, pay later (BNPL) model, giving shoppers the freedom to snag their must-haves immediately while spreading the cost over several payments. Both platforms have captured the hearts of millennials and Gen Z shoppers, boasting acceptance across a diverse range of retail partners.

Both Klarna and Afterpay share a plethora of similarities, making them akin in many ways. These are just a few samplings of how Klarna and Afterpay mirror each other:

- Pay on time and say goodbye to fees: Dive into a world where on-time payments to Klarna and Afterpay spell the end of interest and fees. This delightful duo stands out as a wallet-friendly alternative to the high interest landscapes typically navigated with credit cards.

- Accepted by a broad spectrum of retailers: Klarna and Afterpay have found their way into a multitude of shopping locations, encompassing both the digital e-commerce platforms and brick-and-mortar storefronts. This wide acceptance opens a door of convenience for shoppers eager to indulge at their beloved outlets.

- A hit among millennials and Gen Z shoppers: Klarna and Afterpay have won the hearts of millennials and Gen Z shoppers alike. These younger generations are more inclined towards embracing BNPL services, thanks to their comfort with digital solutions and a keen awareness of their spending habits.

- Provide a mobile application: Just like Klarna and Afterpay, offering a mobile app can significantly enhance your customer’s experience by providing them with the means to effortlessly monitor their payments and oversee their accounts right from their smartphones. It’s an incredibly handy tool for managing BNPL transactions and ensuring timely payments.

Which is better Klarna or Afterpay?

Deciding between Klarna and Afterpay hinges on several considerations, like your business’s unique needs, the geographical area you serve, and what your customers prefer. It’s wise to meticulously review the offerings, costs, and how easily each platform integrates with your current setup before choosing the option that aligns perfectly with your online commerce objectives.

Conclusion

When delving into Klarna versus Afterpay, it’s evident that both platforms deliver the enticing “buy now, pay later” option, enabling consumers to stagger their purchases without the burden of interest fees. Although they share this fundamental feature, selecting the right one could hinge on personal tastes, the variety of retail alliances, and where you are in the world. Shoppers would do well to weigh aspects like penalty charges, the elasticity of payment plans, and each service’s particular conditions to determine which meshes more snugly with their spending habits. At the end of the day, Klarna and Afterpay both serve up nifty solutions for spreading out payments, thus rendering the virtual shopping cart a little more tempting and manageable for buyers everywhere.

FAQs on Klarna and Afterpay

1. How do Klarna and Afterpay compare in terms of payment plans?

Both Klarna and Afterpay allow customers to make purchases and pay for them over time. Klarna offers more financing options, including the option to pay in 30 days or finance for up to 36 months. Afterpay allows you to pay for products in four installments due every two weeks.

2. What role do Klarna and Afterpay play in e-commerce financing?

Klarna and Afterpay are popular e-commerce financing options that offer customers the ability to buy now and pay later. They are accepted at well-known brands like Bed Bath & Beyond, Nike, and Old Navy.

3. What are the consumer credit options offered by Klarna and Afterpay?

Klarna and Afterpay do not disclose minimum credit score requirements. Both providers only perform a soft credit check. Most transactions require a 25% down payment and subsequent payments of 25% every two weeks until paid off.

4. What are the late payment fees for Klarna and Afterpay?

If you pay late, Klarna’s late fee is $7, while Afterpay charges at least $10 for late payments. They can reach up to 25% of the purchase price or $68, whichever is cheaper.

5. How do Klarna and Afterpay offer retail shopping flexibility?

Klarna is accepted at more than twice as many retailers as Afterpay and can be used anywhere Visa is accepted. While Klarna has gained traction in many European countries, Afterpay is a more popular option in North America. This gives consumers the flexibility to shop at a wide range of stores.

6. What is the downside of Afterpay?

Afterpay's downsides include late fees that can amount to 25% of the original order cost and its limited usability to partner stores. The lack of a wide variety of payment plans compared to Klarna can also be seen as a limitation. Afterpay will charge a late fee for missed payments, which not all BNPL providers do.

7. What is the downside of Klarna?

Klarna's disadvantages include the potential impact on your credit score due to its financing account and the additional fees for certain payment methods. Klarna's late fees are also a concern, although they tend to be lower compared to Afterpay

8. Is it better to pay with Klarna?

Whether Klarna is a better payment option depends on individual needs. Klarna offers more payment plan options, including longer-term financing with interest, which might appeal to those needing more flexibility. However, for smaller and simpler transactions, Afterpay might be more suitable

9. Does Amazon accept Klarna?

Amazon's acceptance of specific BNPL services like Klarna varies by region and is subject to change. Customers are advised to check Amazon's payment options at checkout for the most current information.